Being a High-Risk Driver: What You Need to Know

🚧 Understanding the High-Risk Driver Label

Being a High-Risk Driver: What You Need to Know.

High-risk drivers are individuals deemed more likely to file insurance claims based on factors such as:

- Multiple at‑fault accidents or speeding tickets

- Convictions like DUI/DWI or reckless driving

- Frequent claims history or policy lapses

- Young or inexperienced drivers

- Poor credit score or high-risk residential location

Once flagged, drivers face significant consequences in both cost and coverage.

📉 Financial Impact—Premiums & Coverage Limits

📈 Premiums Skyrocket

Insurance providers charge high-risk drivers much higher premiums sometimes 50–100% more—or more depending on the severity of past records. Reckless behavior or DUIs can trigger rate increases by 70-100% or even lead to denial of coverage.

🚫 Restricted Coverage

Insurers may increase deductibles, exclude certain claims (e.g., DUI-related incidents), or offer only basic liability policies. Full comprehensive coverage or add-ons may be unavailable for high-risk profiles.

⛔ Policy Cancellation & Limited Choices

Insurance companies may decide not to renew your policy or even cancel it especially after serious violations or repeated infractions. Once that happens, finding new coverage is hard; options narrow to high-risk brokers or assigned-risk pools.

🛑 Loss of No Claim Bonus (NCB)

High-risk status often resets the discount on your premiums known as the no‑claim bonus. Frequent claims or violations result in losing this benefit entirely, further inflating renewal premiums.

⏳ The Lasting Effect: Status Duration

Most violations, like speeding tickets, remain on record for about 3 years, and at-fault accidents for up to 6. A DUI conviction can stay visible for 5-15 years. Until then, high-risk premiums remain, even if you clean up your act now.

👁 Real-World Stories: What Happens Next?

From forums and user stories:

“My policy was cancelled after an accident even though I wasn’t at fault. Now no insurer wants to cover me unless it’s through less reputable channels.” (Despite attempts to appeal, insurance remained out of reach.)

“I was quoted $350+ per month for minimum coverage after multiple accidents. Today, rates can exceed $1,000/month in extreme cases.”

These illustrate the severe barriers high-risk drivers face when seeking ordinary insurance plans.

🧠 Why Insurance Companies Do This

Insurers rely on a risk profile to assess likelihood of a claim (preferred, standard, or nonstandard/high-risk). High-risk status skews calculations heavily. Insurers manage this through higher premiums or exclusion to offset expected claims. Some jurisdictions assign drivers to assigned‑risk pools where basic coverage is still mandatory, but expensive.

🤔 Broader Disadvantages Beyond Insurance

- Legal consequences: Multiple violations may lead to license suspension, fines, or civil suits.

- Financial strain: Soaring premiums limit mobility potentially forcing drivers to rely on rentals or public transport.

- Behavioral traps: Risk compensation may lead risky drivers to behave even more unsafely, worsening status.

- Limited vehicle choice: High-risk status may restrict access to preferred car models or clubs.

✅ Turning the Tide: Recovering from High-Risk Status

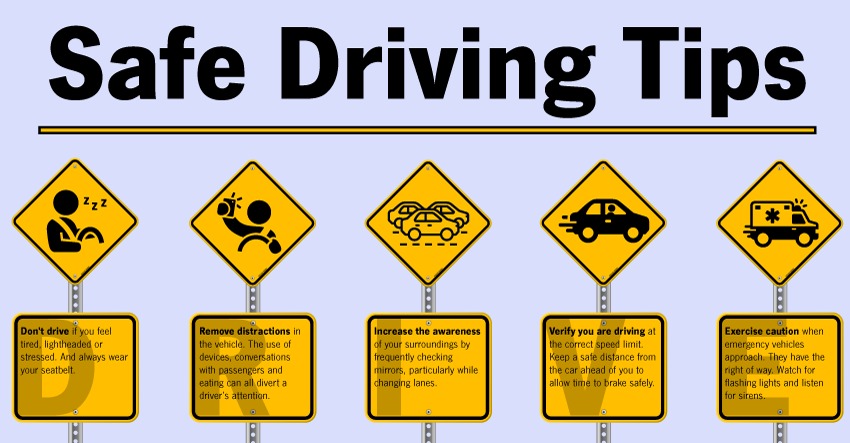

- Drive Safe & Avoid Violations: Clock doesn’t run until you maintain a clean record for several years.

- Defensive Driving Courses: Recognized certification can earn premium discounts.

- Telematics or Black Box Insurance: Real-time safe driving data can restore trust.

- Maintain Continuous Insurance: Avoid lapses in coverage gaps count against you.

- Improve Credit: In regions where credit history affects risk rating, a strong score helps.

- Shop Around or Use Brokers: Alternative insurers or risk pools may offer options where mainstream providers won’t.

✅ Summary: Big Picture Takeaways

| Key Disadvantage | Effect on the Driver |

|---|---|

| Higher premiums | Immediate financial strain |

| Lower coverage options | Restrictions on benefits and add-ons |

| Loss of No Claim Bonus | Repeatedly paying full price |

| Policy cancellation risk | Limited insurer options and increased cost |

| Extended impact duration | Record visibility for years |

| Inconvenience & legal risk | Penalty points, license suspension, lawsuits |

📌 Final Thoughts & Tips to consider

Being classified as a high-risk driver comes with heavy financial, legal, and lifestyle penalties. But with intentional steps safe driving, record cleanup, smart insurance choices you can rebuild your driver profile. The sooner you act, the faster you’ll requalify for lower rates and broader coverage.

Want a breakdown of average premium increases for specific violations, or a checklist to rebuild trust with insurers? Just let me know I can craft that next!